NIOtime #20: To buy or not to buy?

Technical Chart. Media News Recap. NIO App Stories. All from a group of NIO global fans exclusively for the NIO community.

This week let’s welcome 43 new members to join us on board to grow together with NIO! If you’re reading this but haven’t subscribed, we invite you to join the 1,576 NIOtime community by subscribing here!

Dear NIOtime gang,

It’s NIO time, Blue Sky is here!

How are you doing last week? We had a roller coaster ride the last few days with the NIO share price jumping high on Monday, given generally positive Wall Street analyst updates after NIO day. The NIO’s new 1.3B convertible notes offering news on Tuesday pulled off the stock rally and cooled down the hype following the fear of delisting Chinese companies on US stock exchanges and rising COVID-19 cases in China.

This week the news reported that former co-founder and executive vice president of NIO as chief executive officer of its electric vehicle platform and a comment by experts on a solid-state battery hard to scale full production near term. In the EV industry landscape, we will see more cooperations from current ICE makers across the industry (Foxconn & Geely, Apple & Hyundai, Baidu) to get into the EV market share pie sharing, which indicates a confirmed electrification trend sign in upcoming years. In regards to solid-state battery news, we would comment in the following section.

Technical Chart

This week NIO closed the week at $56.27 which is about 4.5% lower than last week’s closing price ($58.92). This week we observed a gap up on Monday and hit $66.99 for 52W High and came back down to fill the Monday gap this week. This is a good sign as NIO filled the Monday gap, however, there is a previous gap formed last week. The gap between $54.61 and $55.67 is expected to fill soon.

For the record, NIO don’t sell the news after the NIO day but cooled down by new convertible notes offering on Tuesday. This is good signs from the investors that the future of NIO is looking bright. From technical chart, NIO broke its EMA8 ($57.92) and looking closely for EMA21 ($53.48) and EMA50 ($48.46) as these two price levels can serve as short term retracement zone for NIO.

Next few weeks we would anticiapte January delivery updates on first week of February, a potential 2nd joint factory news confirmation, and Q4 earning date confirmation likely falls on February.

This Week’s Top 6 Highlights by @theNIOtime

$1.3 billion Convertible Notes Offering

Wall Street Analysts Update Summary

Second Joint Factory Plant Rumor

Expert Downplays Solid-state Battery Hype

NIO Power Update

NIO House & Space Update

News

$1.3 billion Convertible Notes Offering

NIO on Wednesday announced interest and conversion prices for its $650 million convertible notes due 2026 and $650 million convertible notes due 2027. The 2026 notes will not bear interest, and the principal amount of the 2026 notes will not accrete. The 2027 notes will bear interest at a rate of 0.50% per year, payable semiannually in arrears on February 1 and August 1 of each year, beginning on August 1, 2021.

The 2026 notes will mature on February 1, 2026, and the 2027 notes will mature on February 1, 2027, unless repurchased, redeemed, or converted following their terms before such date. Before August 1, 2025, in the case of the 2026 notes, and August 1, 2026, in the case of the 2027 notes, the notes will be convertible at the option of the holders only upon satisfaction of certain conditions and during certain periods. (News & Source: NIO)

Many may treat this new offering as similar than previous secondary stock offering, however, this time is different as NIO deployed the another capital raising mechanism like senior convertible notes. An interested holders of these notes can purchase the notes with rights to exercise or earn interest until the maturity year. The company can redeem at the higher price or the holders can exercise and buy share at predetermined price.

In this case, both of the initial conversion rate of the 2026 and 2027 notes is 10.7458 ADSs per US$1,000 principal amount of such notes, which is equivalent to an initial conversion price of approximately $93.06 per ADS and represents a conversion premium of approximately 50.0% above the closing price of its ADSs on January 12.

This is good for both NIO and notes holders which NIO gets additional cash without diluting our shares while giving low interest for notes holders for borrowing money to NIO and rights to exercise at $93.06 upon maturity.

Wall Street Analyst Rating Update Summary

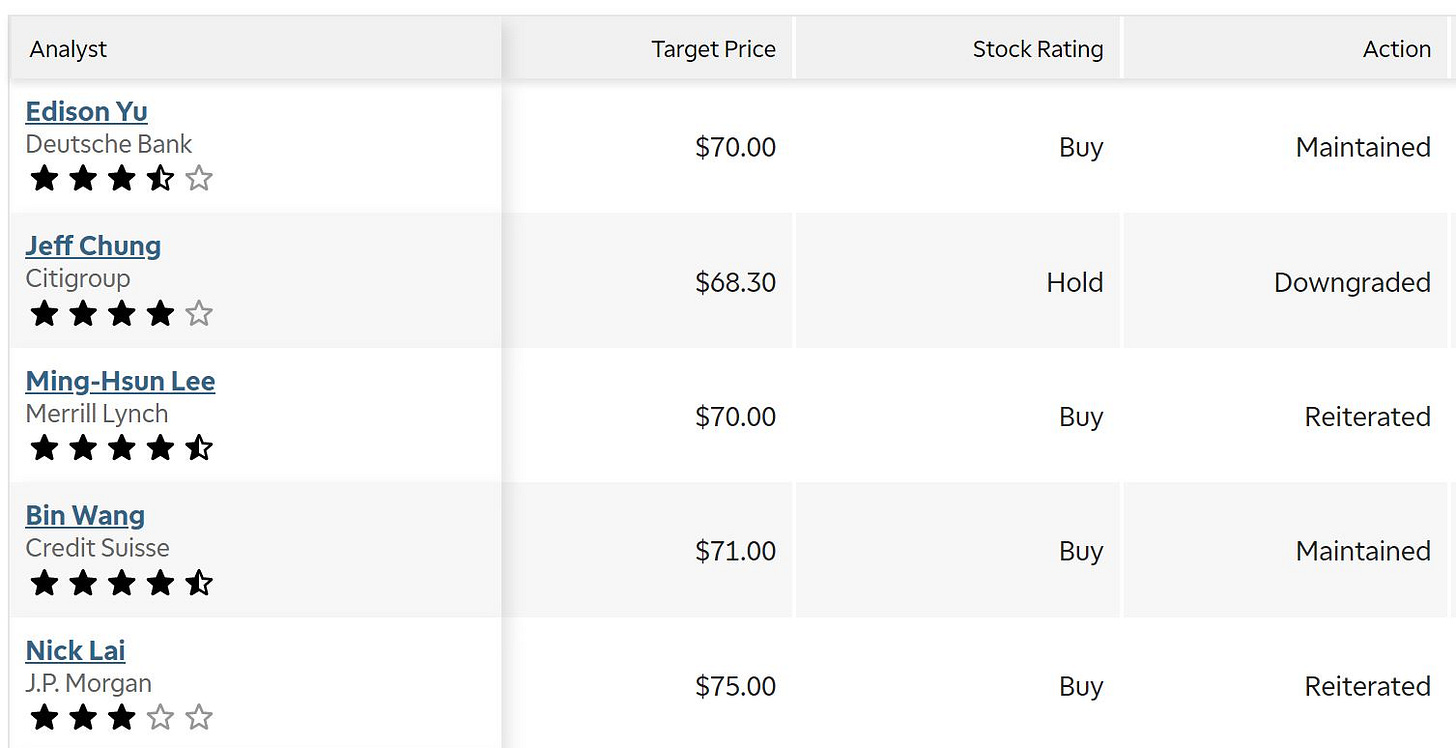

This week as expected, we observed several analysts released their price target after reviewing the pitched products on NIO day. Here’s the summary of the analyst rating update obtained from the TD research portal.

Based on the current analysts data available on TD research portal (excluding ratings from local analyst in China), the average price is at $57.61 with an upside to $75.00 which is from JP Morgan analyst. In our view, these price target are relatively low and we maintain our EOY price target of $96.00 given NIO demonstrates the production and delivery vehicle up to target 90,000 units in 2021 as mentioned in this issue. Remember there is risk associated with the price target giving rising concerns over COVID-19 mutation in Europe & USA and new rising cases in China.

Second Joint Factory Plant Rumor

According to a recent government document, we tweeted this news of NIO may build a second joint plant in Hefei, next to the existing JAC NIO plant.

A tender document dated December 24 shows that the Hefei Economic and Technological Development Zone's Key Project Construction Management Center is seeking bids for the plant construction project, with an estimated contract value of RMB 18.0759 million.

The Hefei advanced manufacturing base currently has more than 2,000 JAC-selected technicians and over 200 engineers from NIO's manufacturing, quality, supply management, and R&D fields based at different world-renowned automakers such as Volvo, Mercedes-Benz, and BMW. (News Source: Sina & cnEVpost)

NIO needs 2nd joint factory to show confidence in scale production capability to catch up increasing EV demand in upcoming years. The top bearish reason that NIO bears is NIO don’t have its own factory like Tesla. If this rumor is confirmed by the officials, this may boost confidence among NIO investors as well as convince new NIO investors. We truly trust NIO’s management team to make decision about their timing to expand their joint factory or even build their own factory eventually to ramp up in-house production.

Remember NIO’s current level is not comparable to Tesla’s current level in which ahead of NIO few years in terms of vehicle production and others. IMHO, NIO has to prioritize the capital wisely in right categories (R&D advancement, international expansion, etc.). The new factory is just a matter of top management’s judgement and timing. Given the speed for new factory deployment as shown in Tesla China, we don’t worry too much about the production scaling for NIO in China. We would rather hope NIO emphasing on their aggresive user base expansion and premium brand recognition in China as well as international markets.

Expert Downplays Solid-state Battery Hype

At the NIO Day held on January 9, NIO, in addition to unveiling its first ET7 sedan, Li Bin announced that NIO would deliver a 150kWh solid-state battery capable of giving the sedan a range of more than 1,000 kilometers in the fourth quarter of 2022.

Experts say the large-scale application of solid-state batteries to be after 2025, technology and cost issues remain to be resolved. "The 150kWh solid-state battery released by NIO is not an all-solid-state battery, but a hybrid-solid-state battery containing a small amount of electrolyte." Wu Hui, general manager of the research department of Yin Wei Institute of Economic Research, told reporters that it would take at least 5~10 years for the all-solid-state battery to be industrialized from the current development status. The semi-solid-state battery released by NIO has a relatively short time to achieve industrialization and may be installed onboard in the next 2-3 years. (News Source: 36kr)

In our opinions, we are less hype about NIO going the route to solid-state battery. The solid-state battery is promising technology for battery breakthrough, however, in mass production, there lies cost, safety and production scale problems.

According to our intel, we believe that NIO's solid-state battery is actually a hybrid solid-state and liquid battery or a semi-solid-state battery as full solid-state battery can achieve more than 500 wh/kg. NIO’s claim on solid-state battery is not wrong as hybrid solid-state is considered under solid state tech. In regards with potential solid-state battery supplier, this could be some local supplier other than CATL.

In our opinions, we have confidence about NIO’s timing to release of 150 kWh battery in promised timeframe. We think that there is high likley NIO can deliver first low-volume batch of 150 kWh in Q4 2022 and plan to roll out mass production following year. This is matching with expert’s insights of launching mass production of hybrid solid state battery in the next 2-3 years.

NIO Power Update: 178th Power Swap

So far, NIO has one new Power Swap station that sums up to 168 power swap stations and five new Power Charger stations, which sums up to 100 power charger stations in China. (News Source: NIO App)

NIO Power Swap # 178 | Jinqiao Plaza, Shanghai

NIO House & Space Update

NIO has no reported new NIO Spaces launching this week, which currently sums up 217 NIO houses and spaces in China. For older photos, please kindly refer to our NIOtime Facebook photo albums here. (News Source: NIO App)

Summary

Shall we buy or not to buy now?

Let’s recap NIO is positioned 5th with a market cap of 87.7B. We foresee NIO hitting the 300B market cap in the next 3-5 years and securing the no.2 leader in the automaker leaderboard. There is about 250% upside to the target market cap.

Let’s remind ourselves as NIO long term investors, we should wait PAYtiencely, accumulate on every dips, stay convicted every week, and cheers for the ups and downs of NIO in 2021. Some of you may become NIOnaires already or eventually becoming one of them sooner.

We will periodically post quick updates on our NIOtime Instagram, NIOtime Twitter, and NIOtime Facebook. Please follow us on social media to interact with us and let us know your thoughts and suggestions.

If you like what NIOtime is sharing about NIO, please help us share and grow the community to let more people know about NIO.

Been in the stock since $7. NIO has a great future and there are still some clueless idiots that like giving there predictions on NIO going lower. They do this because they they own no stock or are short. Just hold your shares, and put them away for 5 years and pay no short term capital gains. So much happening with NIO its a good spot to be for long term future and ignore the haters noise

Nio stock had a disappointing week and is losing all the gain from NIO day. All those TP upgrades and new factory news did nothing but pushing the price lower and lower. With Lucid automaker IPO, investors will move from all Chinese EV stock to Lucid that will make the price go below $40.